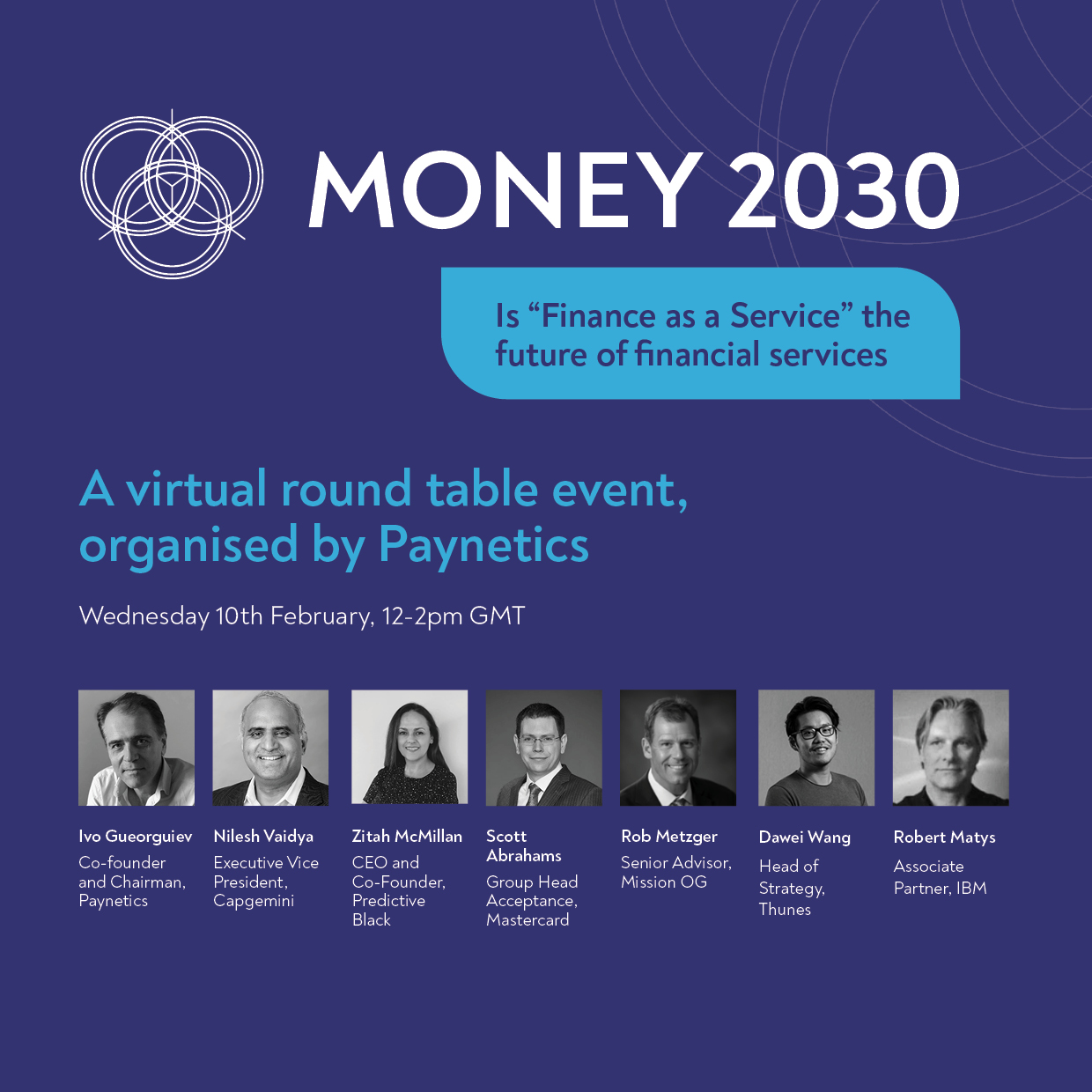

In the second of our series of events on the future of fintech and financial services, we are going to be taking a deep-dive into how financial services will be provided in the next decade, focusing on the fast-growing area of “Finance as a Service”. The prevalence of cloud computing, new AI-enabled systems for better understanding customers through data and the rapid pace of innovation have led to new fintech services being launched all the time. Credit as a Service has the potential to revolutionise B2B payments and the provision of consumer credit. Banking as a Service has the potential to create a platform for providers of different financial services to collaborate and provide on-demand digital banking for every customers’ needs 24/7. At our next Money 2030 event, which will take place on Wednesday 10th February from 12noon to 2pm GMT, we are asking what impact this next generation of services will have on the industry, and whether the ultimate future of financial services is “Finance as a Service”. The event will feature companies, experts and advisors from across a number of sectors to explain how, by 2030, every financial service will be provided much like cloud-based software and services are today. You will hear from:

- Technology providers who are developing and commercialising the financial services stacks of the future

- Investors and advisors who are actively working in this space

- Fintech and technology companies who are building the platforms that are enabling this innovation

Confirmed speakers include:

- Rob Metzger, Senior Advisor, Mission OG

- Dawei Wang, Head of Strategy, Thunes

- Nilesh Vaidya, Executive Vice President, Capgemini

- Scott Abrahams, Senior Vice President, Business Development & Fintech, Mastercard

- Zitah McMillan, CEO and Co-Founder of Predictive Black

- Robert Matys, Associate Partner, IBM

This will be held virtually via Zoom video conference, and you will have the opportunity to ask questions of our speakers and discuss the future of fintech and financial services with your peers in a secure online round-table format. Sign-up using the form below to receive an invitation with access details for the event: